We’ll use a 20 yearinvestment term at a 10% annual interest rate (just for simplicity). As you compare the compound interest line tothose for standard interest and no interest at all, you can see how compounding boosts the investment value. Calculate the future value of money using our compound interest calculator.

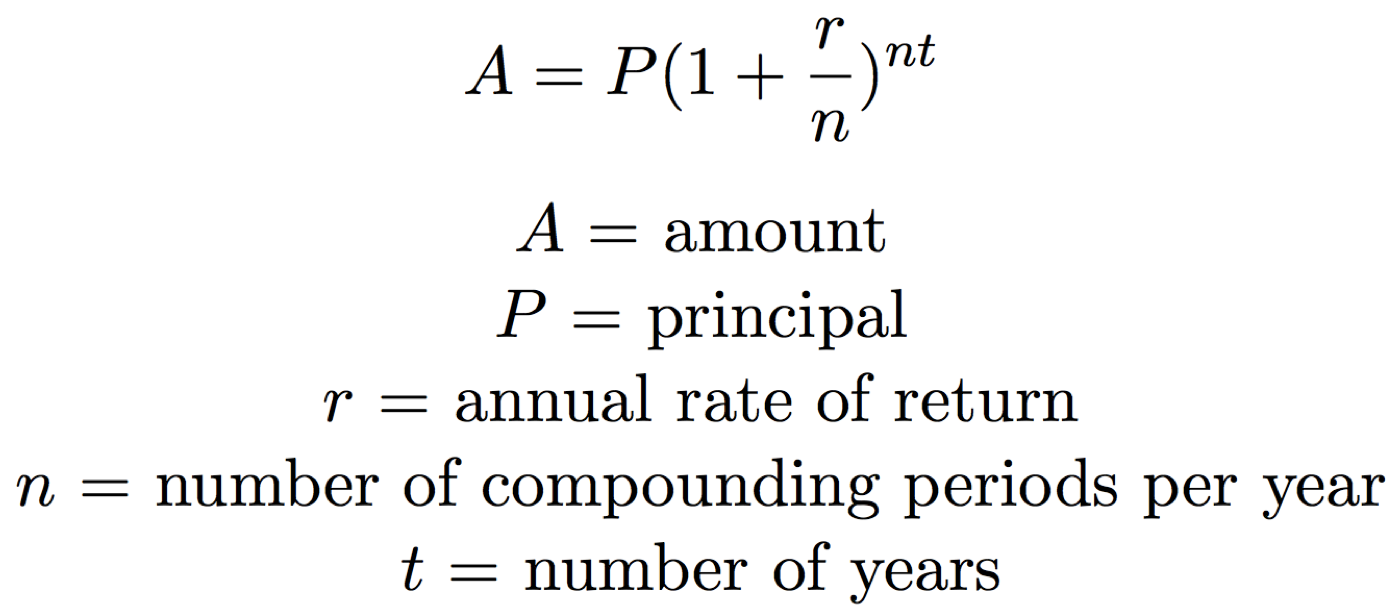

How to calculate compound interest using the formula

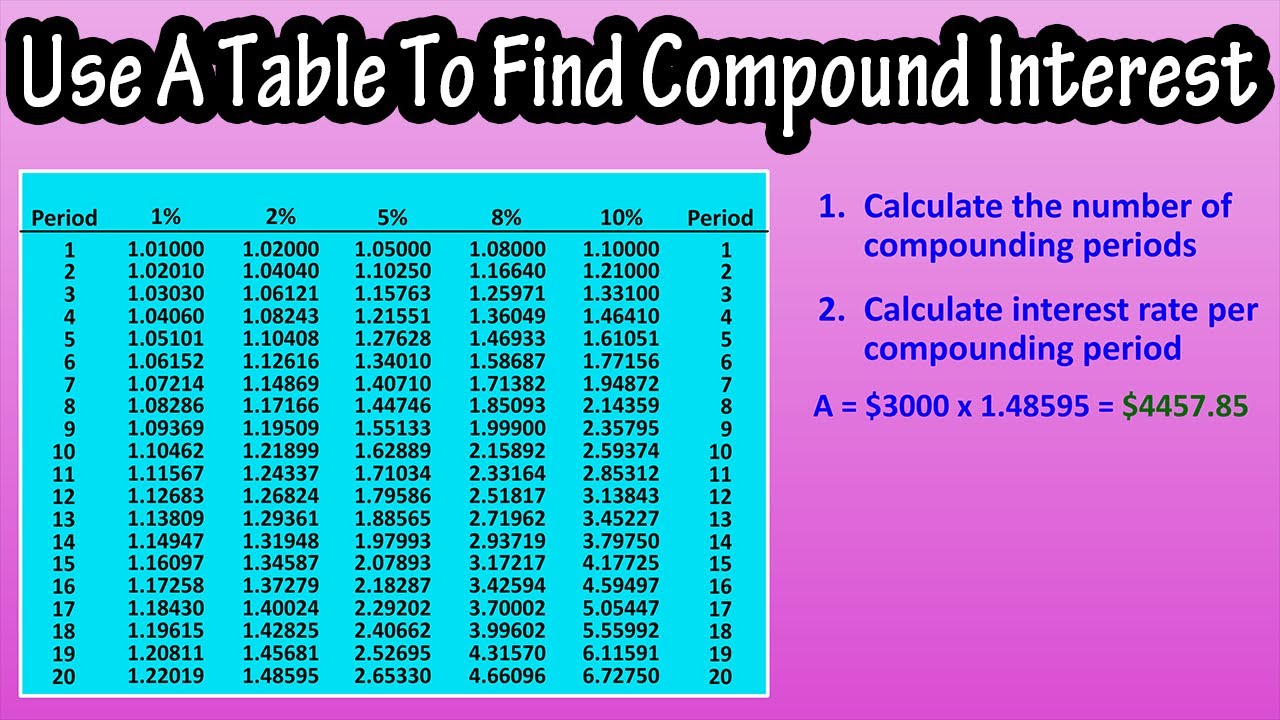

Because n represents the number of compounding periods, and we are compounding semiannually for five years, there will be 10 compounding periods. We multiply five years by a compounding frequency of two (twice per year) to arrive at the number of compounding periods. Now we also can’t use the same rate, because if we have n as 10, and we used our annual rate, then this would be compounding annually for ten years. In order to adjust the rate, we must divide it by 2, since we are now earning 2% per period rather than 4%.

Compounding investment returns

It states that in order to find the number of years (n) required to double a certain amount of money with any interest rate, simply divide 72 by that same rate. When the loan ends, the bank collects $121 from Derek instead of $120 if it were calculated using simple interest instead. While our formula computes the future value, finding the interest portion is only one more step. All we have to do is subtract our present value from our future value because the future value is simply the present value plus interest. In this case, our total accumulated interest is $216.65 (once again, this is the sum of interest earned each year). Below you can find information on how the compound interest calculator works, what user input it accepts and how to interpret the results and future value growth chart.

Use the Bar Chart to Explore Growth Over Time

With your new knowledge of how the world of financial calculations looked before Omni Calculator, do you enjoy our tool? If you want to be financially smart, you can also try our other finance calculators. In fact, they are usually much, much how to track your small business expenses in 7 easy steps larger, as they contain more periods ttt various interest rates rrr and different compounding frequencies mmm… You had to flip through dozens of pages to find the appropriate value of the compound amount factor or present worth factor.

- It is different from simple interest, where interest is not added to the principal while calculating the interest during the next period.

- Compound interest is the formal name for the snowball effect in finance, where an initial amount grows upon itself and gains more and more momentum over time.

- For standard calculations, six digits after the decimal point should be enough.

This interest is added to the principal, and the sum becomes Derek’s required repayment to the bank for that present time. Compounding interest requires more than one period, so let’s go back to the example of Derek borrowing $100 from the bank for two years at a 10% interest rate. Let’s assume that Derek wanted to borrow $100 for two years instead of one, and the bank calculates interest annually. He would simply be charged the interest rate twice, once at the end of each year. Most banks compound interest monthly based on your daily average balance in the preceeding period. Should you need any help with checking your calculations, please make use of our regular interest compoundingcalculator and daily compounding calculator.

How long does it take for $1,000 to double?

The total interest is the amount of interest that was earned from the investment or accrued on a loan. Input any 4 values of principal, interest, rate, time or compounding frequency and calculate the missing value. So if your time value is in months just divide by 12 to get the equivalent value in years. From the previous chapter on simple interest, the simple interest savings account will earn [latex]\$500[/latex] in interest and have a maturity value of [latex]\$1,500[/latex] at the end of five years.

With regular interest compounding, however, you would stand to gain an additional $493.54 on top. For longer-term savings, there are better places than savings accounts to store your money, including Roth or traditional IRAs and CDs. If you left your money in that account for another year, you’ll earn $538.96 in interest in year two, for a total of $1,051.63 in interest over two years. You earn more in the second year because interest is calculated on the initial deposit plus the interest you earned in the first year.

Simple interest means that interest earned is not rolled back into the balance for future interest calculations. Calculate compound interest on an investment, 401K or savings account with annual, quarterly, daily or continuous compounding. 2) Calculate the periodic interest rate if the nominal interest rate is [latex]7.75\%[/latex] compounded monthly. This means that [latex]6\%[/latex] compounded quarterly is equal to a periodic interest rate of [latex]1.5\%[/latex] per quarter. Interest is converted to principal [latex]4[/latex] times throughout the year at the rate of [latex]1.5\%[/latex] each time.

It’s important to understand how compound interest works so you can find a balance between paying down debt and investing money. Inflation is defined as a sustained increase in the prices of goods and services over time. As a result, a fixed amount of money will relatively afford less in the future. The average inflation rate in the U.S. in the past 100 years has hovered around 3%. As a tool of comparison, the average annual return rate of the S&P 500 (Standard & Poor’s) index in the United States is around 10% in the same period. Please refer to our Inflation Calculator for more detailed information about inflation.